When your finances are out of control, your life is at risk of becoming out of control too. But while it’s important to control your finances, it can be equally difficult without a system in place.

Let’s say you just got a raise at work. Each month, you’re going to split that raise between saving for your children’s college and your retirement. At the end of the first month, you sit down, ready to transfer the money to your retirement fund and college savings account. Yet, the money isn’t in your account.

You scroll through your credit expenses, thinking back to how sure you were that you were within your budget–and how clearly you weren’t. What can you do next month so this doesn’t happen again?

No matter your current financial situation, there are some easy ways to take control of your finances once and for all. Check out these three ideas for how to clarify your financial goals and create a budget that actually works for you.

1 Track your spending

The first step to controlling your finances is learning what state they are currently in. To do this, you have to be aware of what money you are and aren’t spending–and what you’re spending it on. This will also help you realistically budget money for different areas of your life moving forward.

A good way to start is to create a spending tracker. Over the next month, write down every time you spend money and what you spend it on into a spreadsheet. At the end of the month, you should have a better idea where your money is going and any areas of spending you need to reign in.

2 Clarify your money values

Along with tracking how much you’re actually spending, you need to clarify what matters to you and what’s worth spending your money on. This can be highly personal and differ from person to person.

Both Ashley and Chuck spend $20 a week in coffeeshops. When Ashley clarifies her money values, she realizes picking up a coffee on the way to work doesn’t add anything to her life and decides to make her coffee at home.

But when Chuck looks at his values, he realizes his daily coffee shop visits support the lifestyle he’s trying to create because it’s the best way to motivate himself to work on his business after work.

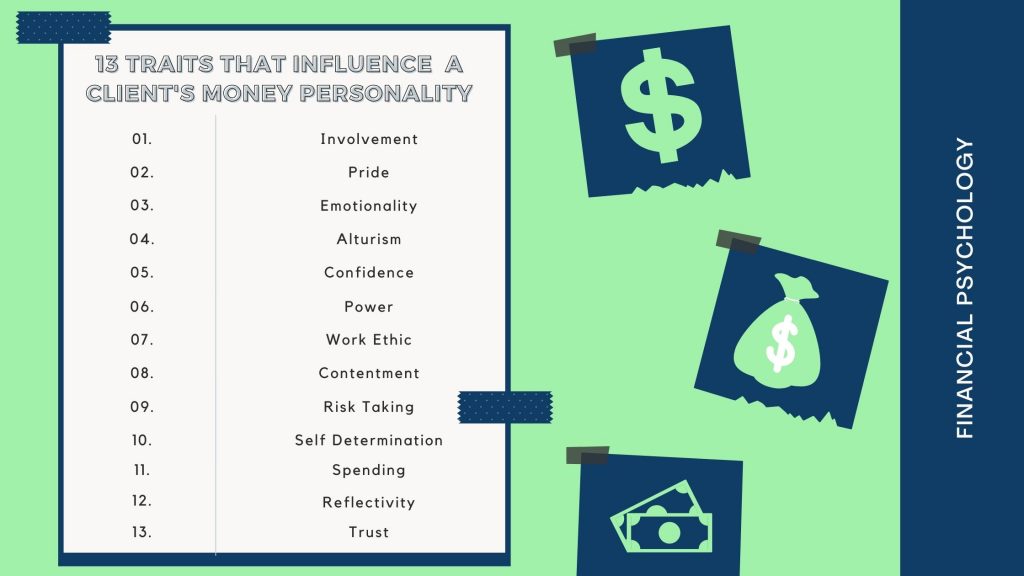

Unsure what your money values are? Knowing your money personality and clarifying the five small expenses that bring joy to your life can help. For example, if your five smaller expenses you love are clothing shopping, shoe shopping, happy hour with your friends, pilates classes, and treating your pet, you most likely value fashion, friendship, fitness, and (furry) family.

3 Set quantifiable goals

Once you’ve clarified your money values and where you’re spending your money, it’s time to set your goals. Goals can help you figure out how much you need to budget in different areas of your life, but only if they are clear and easy to follow.

That’s why it’s important to create quantifiable goals. By adding a numeric quality to your goals, you make them seem more achievable than vague statements. Getting rid of student loan debt isn’t that clear on when and how, but putting $500 a month toward student loan debt is.

Once you’ve completed all three steps, you’re ready to make a budget–the final piece to fully take control of your finances. It can serve as a guide on what to spend money on and what not to spend money on as well as ensure that you reach your financial goals.

Unsure where to start? Check out our free email course on budgeting. When you sign up, you’ll also get a budgeting template to stay on track.