Our financial psychology guides many of our decisions, but we hardly ever talk about it. Your approach to money and personal finance can lead to an early retirement, a robust emergency fund, and a budget you follow…or it can lead to living paycheck-to-paycheck, anxiety about retirement, and the inability to pay all the bills. We’re on a mission to get as many people as possible into the first category with the power of financial psychology.

Since the 1990s, our company has been helping consumers access the power of financial psychology with one tool: the Moneymax assessment. This year, we decided to supercharge our services, giving you easy access to the knowledge you need to transform your finances.

The success of Moneymax

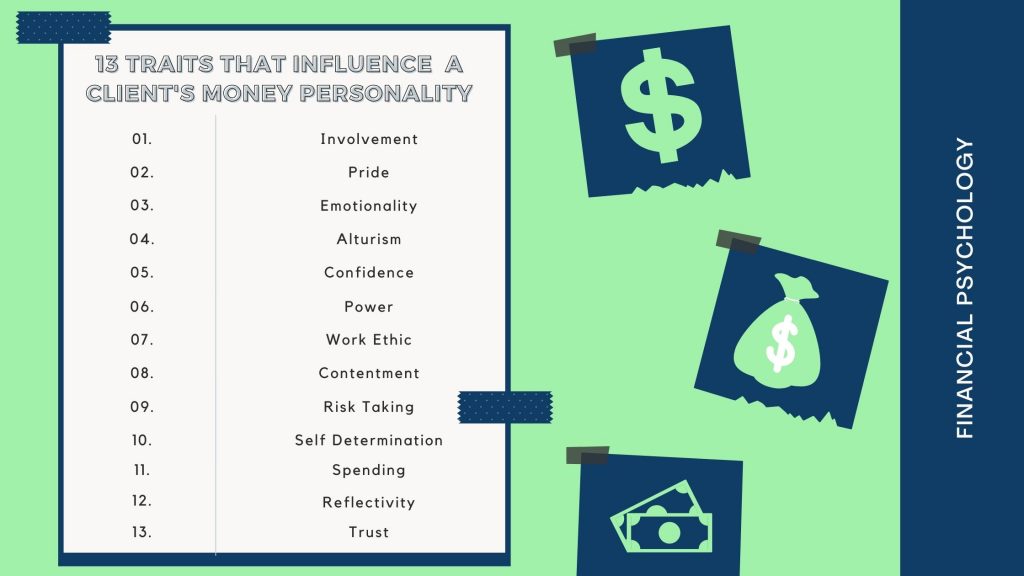

In the 1990s, Dr. Kathleen Gurney developed the moneymax assessment. This quiz tests where someone falls on a sliding scale for 13 different financial traits. From there, they are given a personality type–and a full profile about how that type interacts with money and psychological tricks they can utilize to improve their finances. This profile is interpreted during a meeting with a financial advisor who then creates a plan around someone’s Moneymax type.

I saw the power of this tool as a financial advisor who purchased assessments from the company. This successfully uncovered my financial advising clients’ relationship with money and helped me understand how my clients thought about money for over 30 years. Based on my clients’ Moneymax types, I was able to develop effective financial plans. Based on the financial goals my clients achieved, this tool worked better than anything else on the market.

The end of an era

Yet in 2019, Financial Psychology announced they were going to sunset. Given how important this tool was to my clients, I worked with the founder to successfully transition ownership over to me. To this day, my advising firm still uses this tool with every prospective client. We also sell the tool to advisors all over the US and Australia. Thousands of financial advising practices use this tool to better understand and serve their clients.

Looking ahead

For the first time ever, we’re opening this tool up to the public. Before, only financial advisors could purchase the tool to use with their clients. While this has been a highly successful offer, we wanted Moneymax to be more accessible.

Not everyone has access to a financial advisor, yet everyone CAN find value and insight from the Moneymax quiz. To address this issue, we packaged the Moneymax quiz up into an accessible offer that people wouldn’t need their financial advisor to interpret: the Moneymax Master Method.

The New Offer

The original Moneymax quiz had to be interpreted by a financial advisor. At first, we wondered if there was a way we could give people their results without having them meet with a financial advisor…but we decided the consultation had too much added value. We asked our in-house advisors to conduct consultations with everyone who signed up and the Money Max Master Method was born.

With the addition of a consultation with the financial advisor, the Moneymax Master Method became an impactful three step process that provides clarity around how you approach your finances:

Step 1: Take the Moneymax assessment

This personality assessment is based on research by Dr. Kathleen Gurney. It gives you insight into your money personality and money management preferences. Since its conception in the 1990s, it’s been tested–and had the same accuracy–three times.

Step 2: Schedule Your Moneymax Mastermind

After you take the quiz, you’ll be matched with a financial advisor. Your advisor will set up a call to go over your results.

Step 3: Get Your Moneymax Master Method

Once you’ve had your call with a financial advisor, they’ll send over a Moneymax Master Method. This document includes insight into how you approach money based on your psychology–and customized ways you can increase your money confidence and build long-lasting wealth.

Looking to experience the magic of the Moneymax Master Method? It’s looking for you too. Purchase your package today and watch how enhanced clarity can improve your finances.