Money decisions might seem objective on the surface and some are. Don’t spend more than you make, save for retirement, and consider saving up for a home are generally good pieces of financial advice but to truly understand why someone makes the decisions they do–good or bad–you have to understand how they approach their finances.

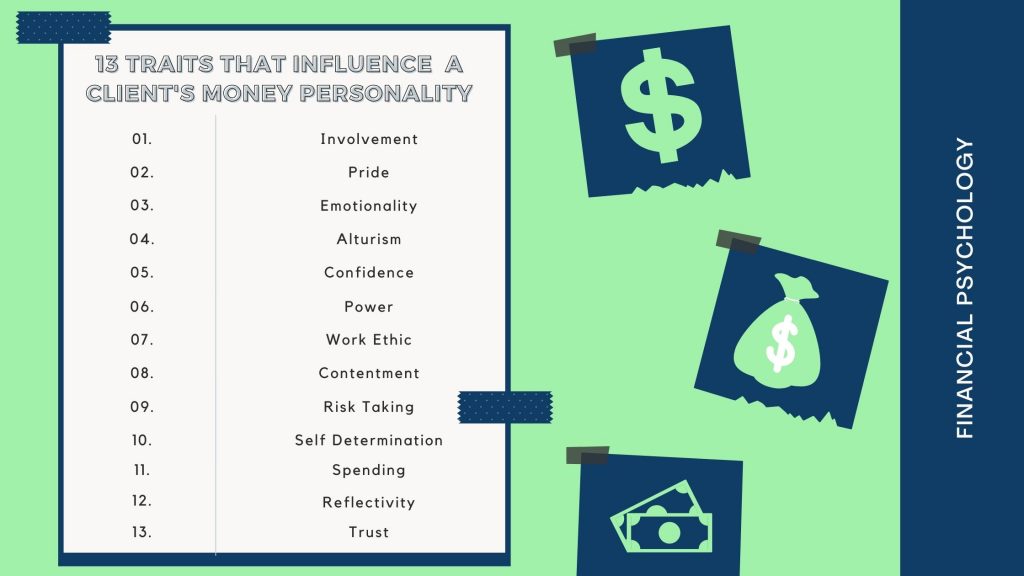

In order to understand this, you must learn more about their financial psychology. Financial Psychology is an interdisciplinary field that studies how principles from psychology impact our financial decisions. 13 financial personality traits in particular influence many of our money decisions.

Involvement

This trait measures how involved a client likes to be in their money management. The more control they want over their money, the closer their score will be to 100. If one of your clients likes is constantly checking their stock portfolio and emailing you, they probably have a high level of involvement.

Pride

This trait measures how proud a client is of their money management skills. The closer their score is to 100, the more pride they have in their money management skills. If a client constantly criticizes their ability to manage money, they have a lower level of pride.

Emotionality

The more guided their decisions are by emotions, the closer they’ll be to 100 while the less guided they are by emotions, the further their score is from 100. A client who’s an emotional spender would score higher for this trait.

Altruism

If a client believes others are financially generous, their score will be closer to 100. In contrast, someone who thinks everyone is greedy and conniving in financial transactions would have a lower score.

Confidence

Confidence reflects how comfortable a client is with their money management skills. The greater their comfort level for managing their own money, the closer their score will be to 100. Someone who feels they are doing a good job managing their money and is comfortable talking about finances with a financial advisor would score higher for this trait.

Power

Power measures a client’s interest in using their money for public recognition. The more your client wants to use money for public notoriety, the closer their score will be to 100. Someone who invests their money in running for a local political office would highly value power.

Work Ethic

Work ethic encompasses how likely a client is to believe hard work will bring success. The closer they are to 100, the more they believe in hard work. Someone who believes corruption and luck, not hard work, brings about success would have a lower score for this trait.

Contentment

The happier they are with their money situation, the closer their score will be to 100. A client who is miserable and always complaining about how they wished they had more money would score lower.

Risk-taking

The level of risk a client is comfortable with when it comes to investments is one of the most used financial psychology traits by financial advisors. A client who is eager to invest in new startups or in crypto currencies with high risk and reward will fall closer to 100 while a client who is scared to invest in safer mutual funds will be closer to 0.

Self-determination

If a client feels their own actions determine their wealth, their score will be closer to 100. If they feel luck plays a bigger role in their money situation, their score will be closer to 0.

Spending

Spending encompasses if a client enjoys spending or saving money. A score closer to 100 means they enjoy spending money more than saving while a client who is frugal and hardly ever spends money would be closer to 0.

Reflectivity

Reflectivity refers to how reflective and analytical a client is in their money decisions. The more reflective a client is, the closer their score is to 100.

Trust

If a client’s level of trust in the integrity of others’ dealings with money, their score will be closer to 100. Those who have less trust ion how others deal with money will have a score closer to 0.

Often, it can take confidence, time, and the right questions to discover where a client falls for these 13 financial traits.

But not with the Moneymax quiz. This tool measures where your clients fall on a scale of 1-100 for 13 characteristics in less than fifteen minutes. Based on their results for those 13 characteristics. If you’re interested in trying out the Moneymax quiz at a special discounted rate, consider subscribing to our newsletter. When you subscribe, we’ll send you a free gift and a discount code.