While every client comes to you for financial guidance, some clients need more hand holding than others. We all know those clients who call every time there’s a dip in the market or who show up in your inbox every week. But what if there was a way you could identify these clients faster and give them the guidance they need, all while respecting your own boundaries and free time?

By understanding your clients’ financial personality types, you can give them the guidance they need without taking too much time out of your day. Knowing your client’s financial personality type offers a variety of benefits including:

- Identifying their pain points faster

- Understanding their financial motivations and approach to money

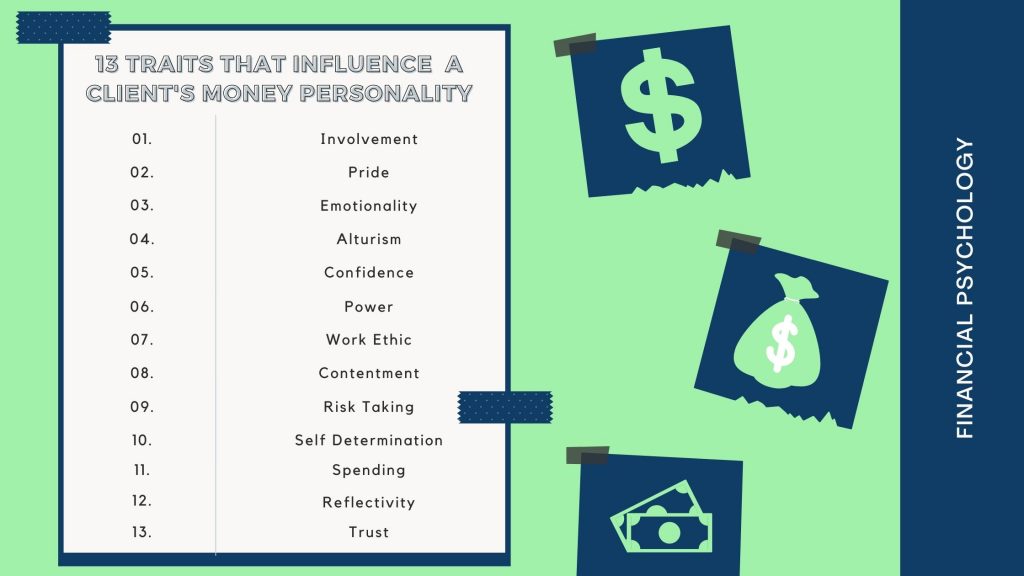

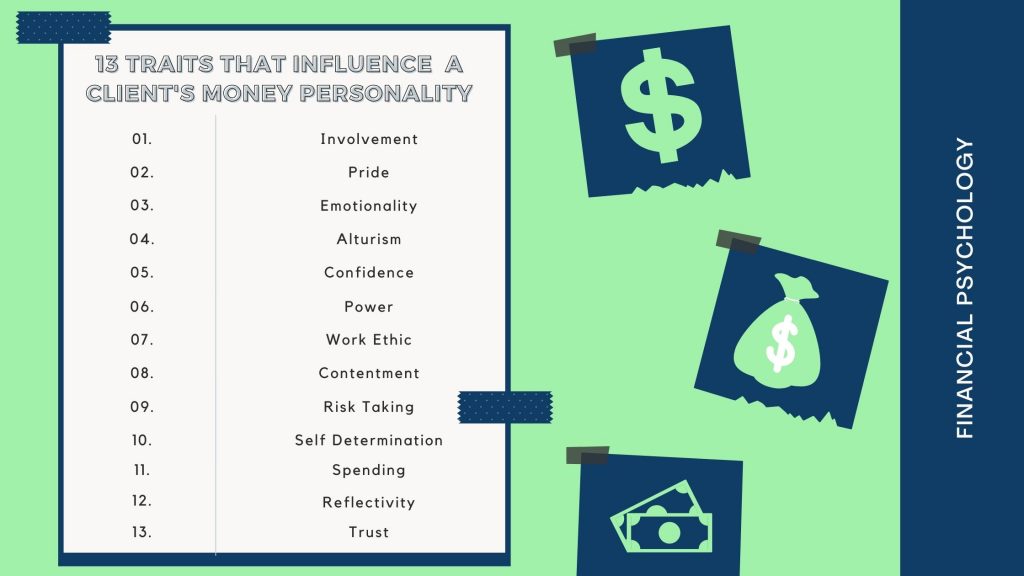

- Determining where they fall on a scale for 13 personality types

- Giving advice tailored to their strengths, weaknesses, and motivations

Each personality type will approach money differently, but financial advising clients won’t always tell you their money mindset, strengths, and weaknesses. The Moneymax quiz, however, allows you to discover someone’s personality type in less than 15 minutes. From there, you can give the right type of advice, especially to those who need more guidance.

Moneymax has nine personality types and of those nine, some need more guidance than others. By knowing what type you are dealing with, you can give the right guidance to each of your clients.

Entrepreneurs

Moneymax entrepreneurs tend to think outside the box, consider career achievements a priority and will take risks to achieve their goals. While some follow the typical image of an entrepreneur and run a large company with many employees or own a small business, others are “intraprenuers”, salaried workers who carve out an entrepreneurial niche within corporations or businesses. Others work a full time job and have a side hustle outside the office.

Entrepreneurs won’t need as much guidance as other types. However, because entrepreneurs and business owners have different financial concerns than regular employees, these clients might need extra guidance on how to manage their finances as a business owner.

Hunters

As one of the most educated and ambitious Moneymax personality types, hunters should be set up for financial and professional success. However, this type does have the tendency to doubt themselves and emotionally spend. Hunters have the ability to play the money game, but they need to learn how and develop the confidence to play on their own.

Hunters could need more guidance because of their lack of confidence. This type might ask more questions and might not be able to stick to a savings plan because they are emotional spenders. To give hunters additional guidance, consider setting up a stricter savings plan that plays into their ambitious spirit (such as a tracker or smaller goals to hit along the way to a bigger savings goal). You might also help build up their confidence by telling them when they did something right with their finances and encouraging them to take a more active role in managing their money.

Optimists

The Moneymax Optimist tends to have a positive money mindset. They are proud of the way they handle their finances and have high expectations for future financial success. The optimist can sometimes overspend on things that bring short term pleasure. Despite their spending habits, they are overall confident and proficient in managing their wealth.

This type probably won’t need as much guidance as other types. But similar to the hunters, they may need some guidance on how to spend their money. If you scaffold their financial plan right and allot some wiggle room for their spending tendencies, this type should be easy to manage and need little guidance.

Perfectionists

Moneymax Perfectionists tend to be overly critical and are afraid to make mistakes when it comes to money management. They often avoid decisions and put off work until they are sure they can do it just right. This type also tends to be frustrated with their financial situation as it’s never perfect.

As a procrastinator, the perfectionist might need more hand holding than other types. While they’re not as likely as the hunter or safety player to ask for your advice, you could find yourself following up with them a few times before they take action. When dealing with perfectionists, make sure to have a plan in place to curb their procrastination and take any needed actions as soon as possible.

High Rollers

Of the nine Moneymax personality types, the high roller is the biggest risk taker. They desire power, influence, and wealth and aren’t afraid to take big risks. They enjoy the thrill of risky money decisions and in spending their money instead of saving it. While their risks can have high reward, their emotional decision-making can sometimes get in the way of their financial success.

As the biggest risk taker, the high roller can be a tricky type to manage. They can be great if you’re looking for clients willing to make riskier financial decisions with a potentially bigger payoff, but these clients aren’t as fun to deal with when those decisions don’t pay off. If any of your clients are high rollers, keep in mind that you may need to make extra time for when their risk taking gets in the way of their financial success.

Money Masters

Moneymax Money Masters tend to be just that–masters of their money and lives. While they are third in income, they are first in assets and are strategic in setting up a good financial future. This group is highly involved in their money management and proud of their achievements.

Money Masters usually don’t need a lot of guidance. When they are first starting to build their assets, they could ask more questions than other types, but overall they tend to be more involved in their money management and will need less hand-holding along the way.

Achievers

The achievers are frugal with their money, believe in the value of hard work, and are interested in protecting what they earn. They tend to mistrust others and want to play an active role in their money management. Achievers are tied with Hunters for being the most educated personality type and are also goal oriented. Unlike hunters, they tend to make more analytical decisions.

Due to their mistrust of others, you either won’t see as many achievers in your practice or these types will ask more questions and be more skeptical than other types. When working with an achiever, expect more questions than usual about your financial practices.

Producer

The Moneymax Producers are one of the hardest working types and tend to be altruistic. However, their assets and income do not reflect their hard work and they’re often frustrated with their financial reality. By changing their negative view of money, they could change their financial future.

The producers usually need a lot of guidance due to their negative view of money and their financial frustrations. This type could email or call you frequently for extra help with their finances. However, if you guide the producer to start building up assets which compliment their hard work, you might be able to better manage this type.

Safety Players

Safety players tend to see financial success as a matter of luck or being at the right place, at the right time. They are less likely than other Moneymax types to believe their individual actions control their financial future. Because of this, they tend to make safe financial decisions with minimal risks. Safety players are also more passive in their money management than other types.

Because of their perceived lack of control over their finances, safety players may need more guidance than other personality types. This type will be more passive with their money management and expect you to do the bulk of the work managing their finances. To help guide safety players, remind them of how much they can control their future and work with them to create a safe, less risky financial plan.

While some types may take more time and attention than others, you can better manage all nine personality types when you understand the strengths, weaknesses, and motivations of each. When you walk into a meeting with a client not knowing their personality type, you are often guessing about their approach to money. When you enter the meeting armed with their money personality type, you can more effectively attend to their questions and needs, saving you time and providing customized financial advising to your clients.